Oil prices rallied Thursday, extending earlier gains after data from the U.S. Energy Information Administration showed that domestic crude supplies dropped by 6.3 million barrels for the week ended June 30. That topped forecasts for a decline of 1.6 million barrels by analysts surveyed by S&P Global Platts, and also came in above the fall of 5.8 barrels reported by the American Petroleum Institute late Wednesday. Supply data were released a day late because of Tuesday’s Independence Day holiday. Gasoline stockpiles also fell by 3.7 million barrels, while distillate stockpiles decreased by 1.9 million barrels last week,

Archives

U.S. crude stocks rose last week while gasoline stocks decreased

U.S. crude stocks rose last week as refineries hiked output, while gasoline stocks decreased and distillate inventories fell, the Energy Information Administration said on Wednesday.

Crude inventories rose by 1.6 million barrels in the last week, compared with analyst expectations for a decrease of 435,000 barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 1.4 million barrels, EIA said.

Refinery crude runs rose by 203,000 barrels per day, EIA data showed. Refinery utilization rates rose by 1.5 percentage points. Gasoline stocks fell by 618,000 barrels, compared with analysts’ expectations in a Reuters poll for a 1.4

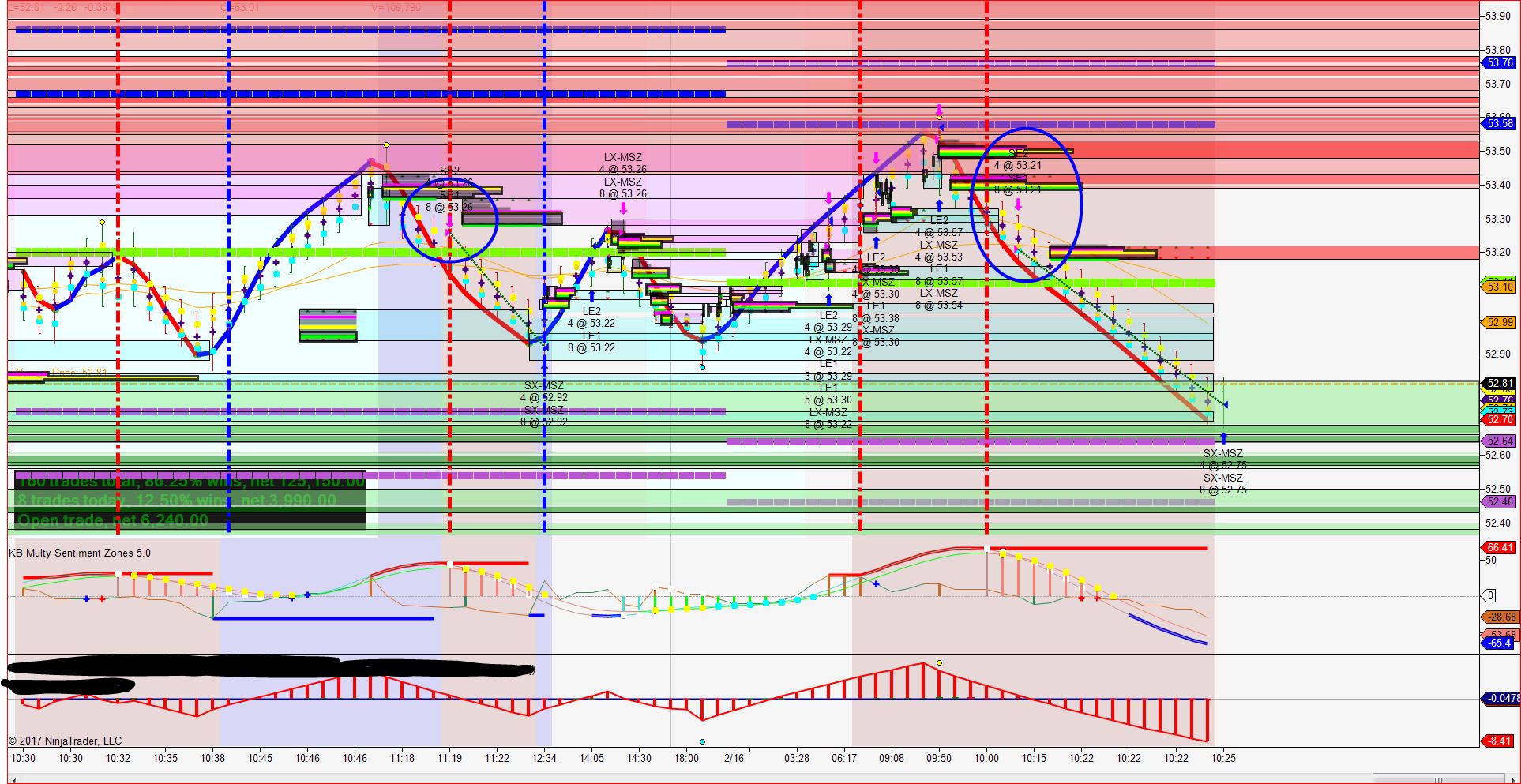

Domestic crude-oil supplies rose by 5 million barrels

The U.S. Energy Information Administration on Wednesday reported that domestic crude-oil supplies rose by 5 million barrels for the week ended March 17.

That marked the tenth increase in 11 weeks. The American Petroleum Institute late Tuesday reported a 4.5 million-barrel climb, according to sources, while analysts polled by S&P Global Platts forecast a rise of 2 million barrels.

Gasoline supplies fell by 2.8 million barrels, while distillate stockpiles declined by 1.9 million barrels last week, according to the EIA. May crude CLK7, -1.14% lost 95 cents, or 2%, to $47.29 a barrel on the New York Mercantile Exchange.

U.S. Energy Information Administration report on Domestic crude-oil supplies felldown

The U.S. Energy Information Administration on Wednesday reported that domestic crude-oil supplies fell for the first time in 10 weeks. Supplies declined by 200,000 barrels for the week ended March 10.

The American Petroleum Institute late Tuesday reported a 531,000-barrel decline, while analysts polled by S&P Global Platts forecast a climb of 3.5 million barrels.

Gasoline supplies fell by 3.1 million barrels, while distillate stockpiles dropped 4.2 million barrels last week, according to the EIA. April crude CLJ7, +2.07% was up 78 cents, or 1.6%, to $48.50 a barrel on the New York Mercantile Exchange. It was trading at $48.70 before the …

American Petroleum Institute reported to build 11.6 million barrels

The American Petroleum Institute (API) reported a build of 11.6 million barrels in United States crude inventories against expert predictions that domestic supplies would see a much kinder 1.4-million-to 1.66-million-barrel build.

The build in crude oil inventories was almost 10 times what analysts had predicted and marks yet another new high in U.S. inventories. The chart below displays a 10-week cumulative build of 35 million barrels, per API data, since the beginning of the year.

A few hours before the API data release, WTI and Brent benchmarks were both down despite Libya’s recent production woes, which were offset by Russia’s.

U.S. Energy Information Administration reported increase in domestic crude-oil supplies

The U.S. Energy Information Administration on Wednesday reported an eighth straight weekly increase in domestic crude-oil supplies, but it was smaller than the market expected. Crude inventories rose by 1.5 million barrels for the week ended Feb. 24.

The American Petroleum Institute late Tuesday reported a 2.5 million-barrel climb, according to sources, while analysts polled by S&P Global Platts forecast a climb of 2.1 million barrels.

Gasoline supplies declined by 500,000 barrels, while distillate stockpiles fell 900,000 barrels last week, according to the EIA. April crude.

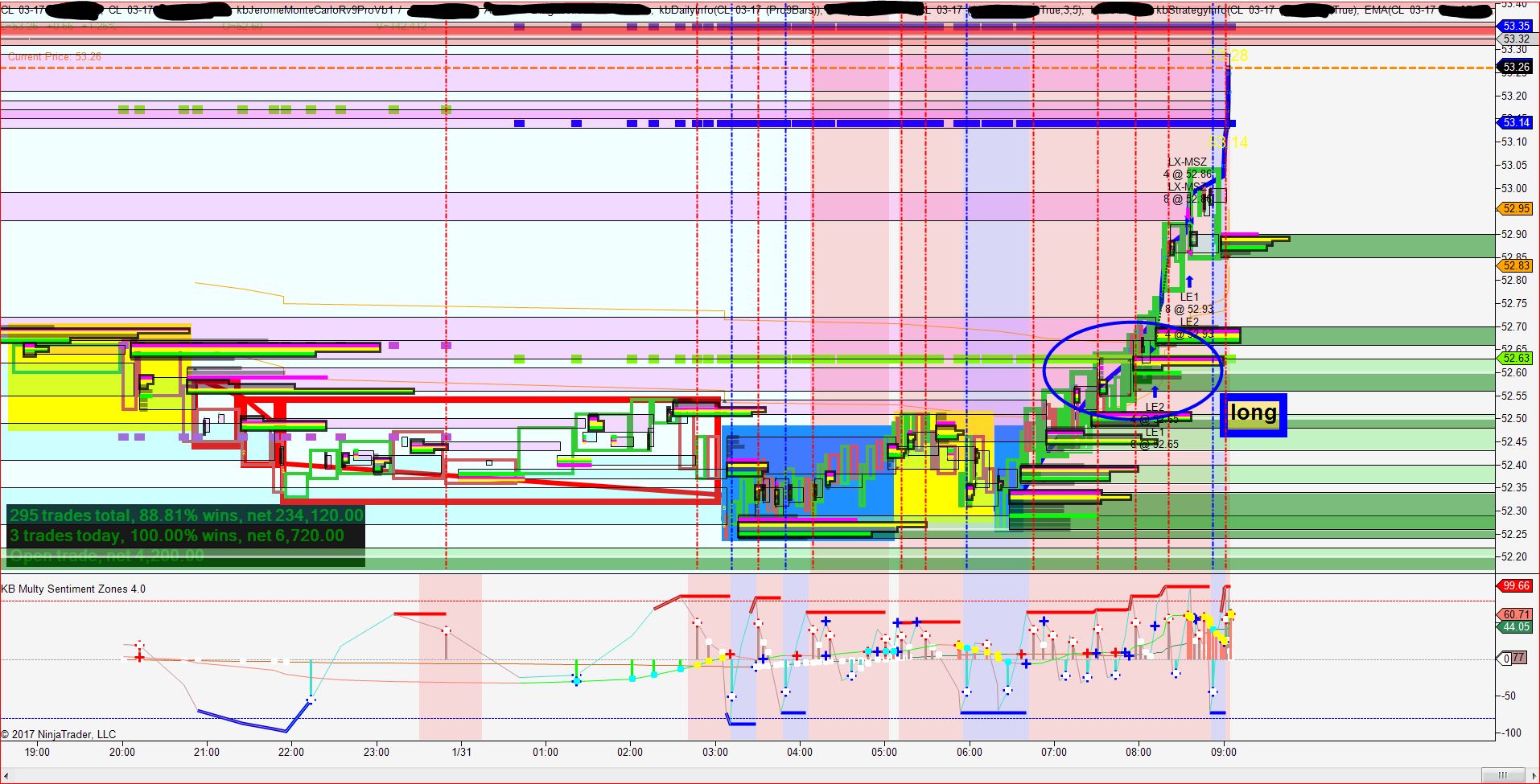

West Texas Intermediate crude oil price raised for April 2017

West Texas Intermediate Crude Oil Price

Oil futures remained higher Thursday after spiking to a session high following a smaller-than-expected rise in weekly U.S. crude inventories.

West Texas Intermediate crude oil for April delivery CLJ7, +2.16% on the New York Mercantile Exchange was up 97 cents, or 1.8%, at $54.56 a barrel after trading as high as $54.94 after the Energy Information Administration said U.S. crude supplies rose 600,000 barrels in the week ended Feb. 17.

Analysts surveyed by The Wall Street Journal had forecast, on average, a 3.4 million barrel rise. Data from the American Petroleum Institute, an industry trade group, late Wednesday had shown an 884,000-barrel.

Oil prices fell after large rise in U.S. crude inventories

Oil prices fell on Wednesday after a government report showed a large rise in U.S. crude inventories.

It signaling ample supply even as OPEC achieves record compliance with its output cut accord.

U.S. inventories rose by a larger-than-expected 9.5 million barrels last week to a total of 518.1 million barrels in the week through Feb. 10, the Energy Information Administration’s (EIA) reported.

Analysts expect U.S. crude inventories to have risen by 3.5 million barrels, for the sixth straight week of gains. Crude stocks at the Cushing, Oklahoma, delivery hub fell by 702,000 barrels, EIA said. Gasoline stocks rose by 2.8 million.

Energy Information Administration

The Energy Information Administration sunk oil markets deeper into despair reporting a build of 13.8 million barrels for commercial crude oil inventories in the U.S. Total commercial inventories are at 508.6 million barrels, above the upper limit for the season.

A day earlier, the American Petroleum Institute reported the second-largest weekly inventory build ever in the history of records, at 14.227 million barrels, versus expectations of a 2.38-million-barrel increase.

Last week, both EIA and API reported substantial builds in inventories, with the EIA figure at 6.5 million barrels for the week to January 27, exceeding API’s.

Volatility Trading

Besides some individual standouts in the Multi- Strategy and Discretionary categories, the Volatility trading sector were the rock stars of 2016. This space is growing each year, and becoming more diverse in the process.

Where we used to see a steady diet of vanilla option selling here a space has added new strategies incorporating VIX futures, with what once was a purely short volatility space rapidly becoming more and more of a volatility trading space, able to profit from either increases or decreases in volatility.

For more on how this sort of trading works (buying and selling the fear gauge futures), we outline it all here and here. The short version is that each Volatility manager tends to approach the VIX from a market structure standpoint – trying to capitalize on its unique tendencies of being a “quadrative” of sorts, (a derivative of an index of a derivative of an index) where arbitrage opportunities can exist when one of the four components of that “quadrative’ doesn’t keep pace with the other legs.