West Texas Intermediate oil extended gains in North American trade on Wednesday, after weekly data showed that oil supplies in the U.S. registered a larger-than-expected draw.

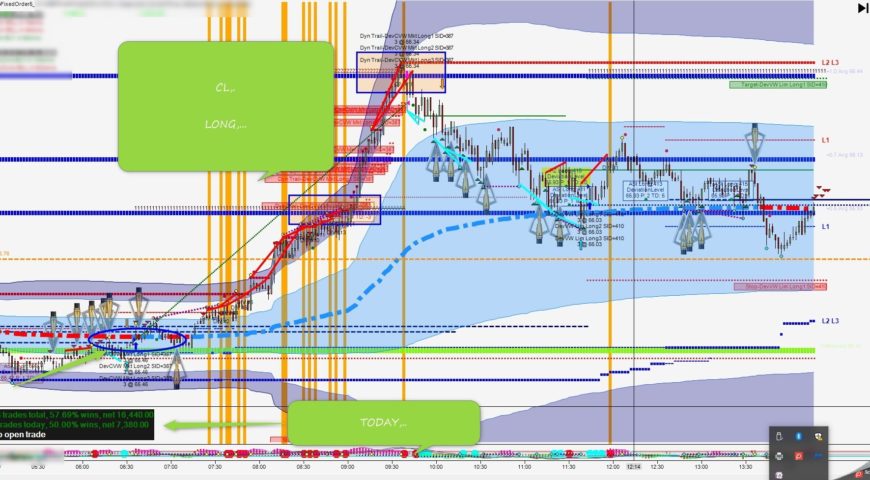

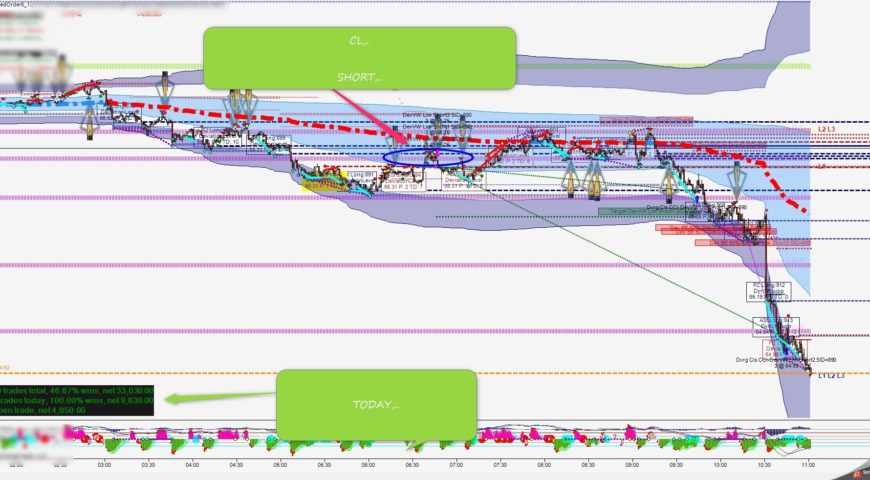

Crude oil for October delivery on the New York Mercantile Exchange rose 91 cents, or 1.33%, to trade at $69.44 a barrel by 10:33 AM ET (14:33 GMT) compared to $69.06 ahead of the report.

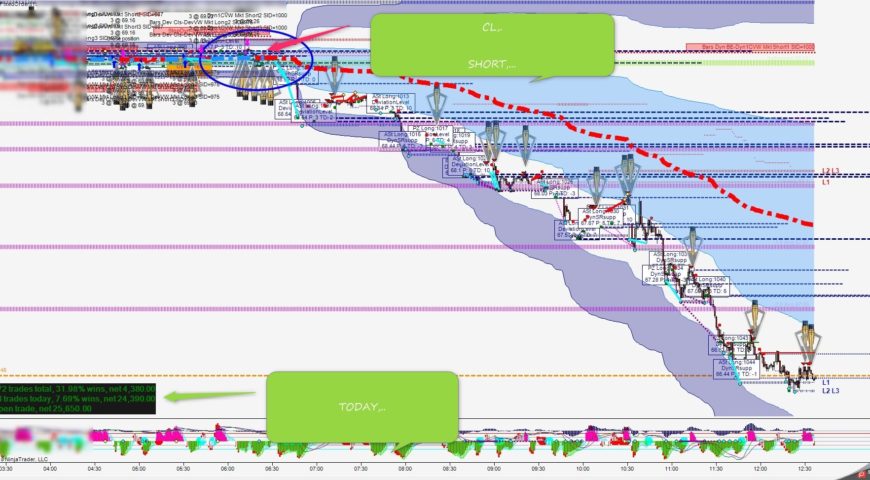

The U.S. Energy Information Administration said in its weekly report that crude oil inventories fell by 2.566 million barrels in the week ended August 24.

Market analysts‘ had expected a crude-stock draw of 0.686 million barrels, while the American Petroleum Institute late Tuesday reported a supply increase of 0.038 million barrels.

Supplies at Cushing, Oklahoma, the key delivery point for Nymex crude, increased by 0.058 million barrels last week, the EIA said.

Total U.S. crude oil inventories stood at 405.8 million barrels as of last week, according to a press release, which the EIA indicated was “at the five year average for this time of year”.

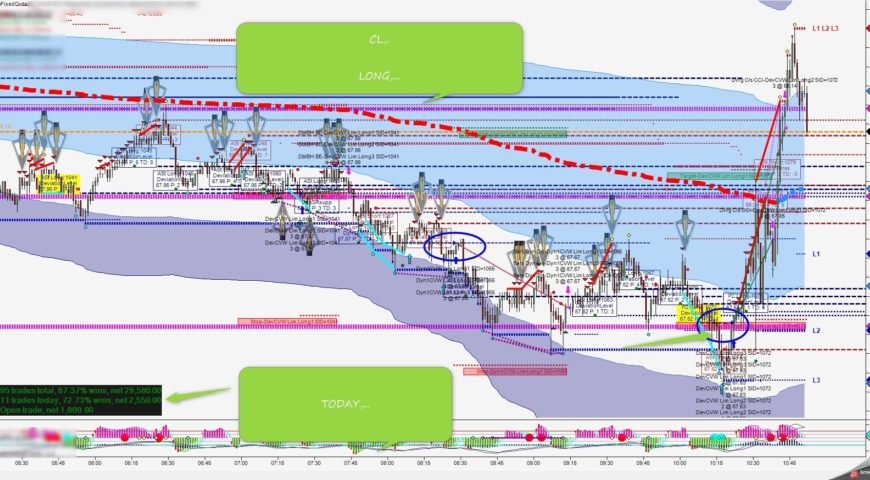

The report also showed that gasoline inventories decreased by 1.554 million barrels, compared to expectations for a build of 0.370 million barrels, while distillate stockpiles dropped 0.837 million barrels, compared to forecasts for a gain of 1.592 million.

Elsewhere, on the ICE Futures Exchange in London, Brent oil for November delivery traded up 61 cents, or 0.80%, to $76.90 by 10:36 AM ET (15:36 GMT), compared to $76.56 before the release.

Meanwhile, Brent’s premium to the WTI crude contract stood at $7.72 a barrel by 10:38 AM ET (15:38 GMT), compared to a gap of $7.76 by close of trade on Tuesday..