USA has steadily increased its crude oil production over the past decade, and in 2015, the country produced 88 percent more crude oil than it did in 2008. Government researchers also estimate that the United States was the world’s largest petroleum and natural gas hydrocarbon producer in 2015. This is truly a new era for American energy.

The United States is once again an exporter of crude oil, with a January 2016 shipment marking the first freely traded U.S. crude in about four decades. Forecasting the oil prices for the next month or next year, that has always been a game of hit and miss.

All the more so in the past two years since the oil price crash began. Oil prices rose up in anticipation of tighter crude supply going into 2017 comparatively to 2016.

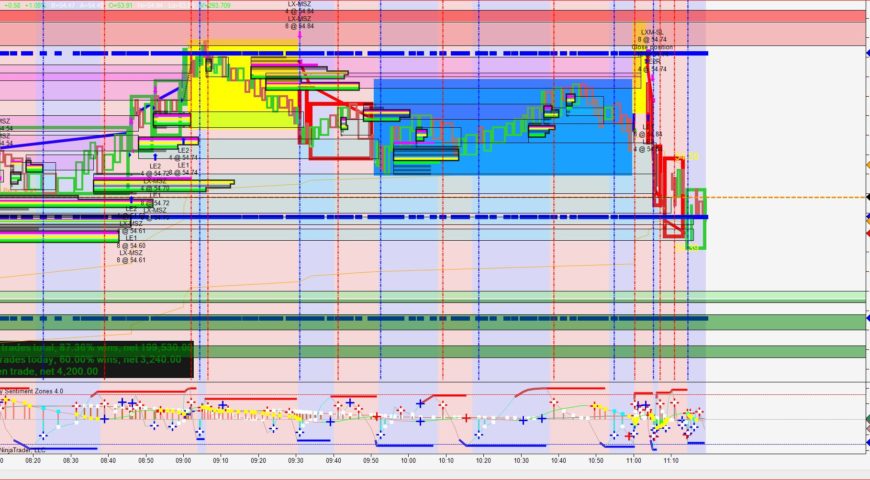

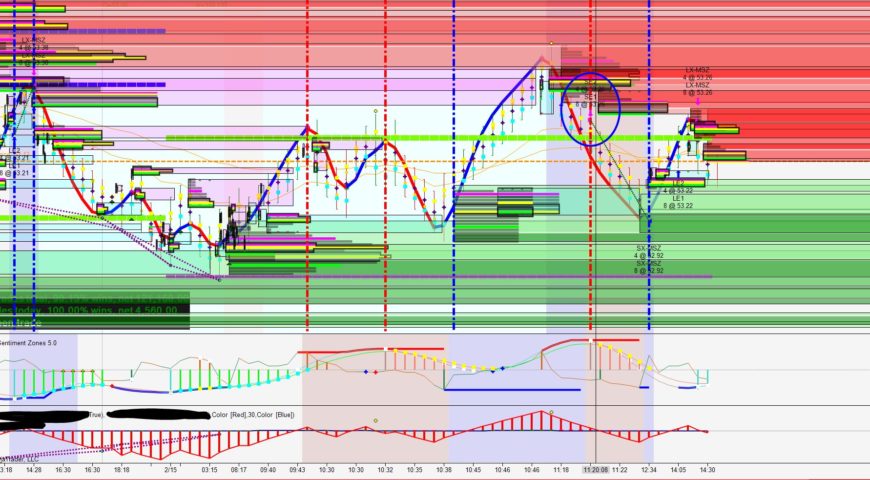

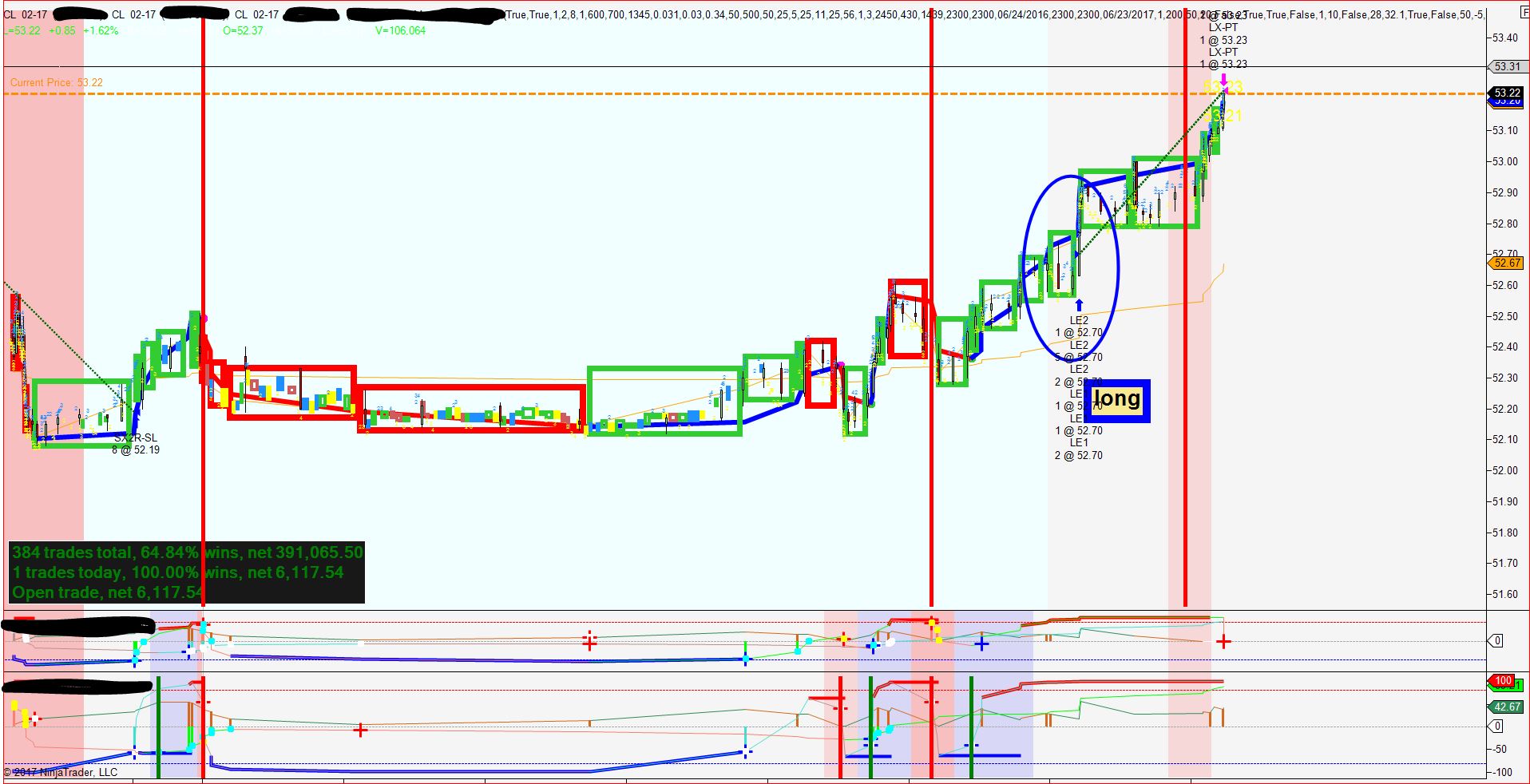

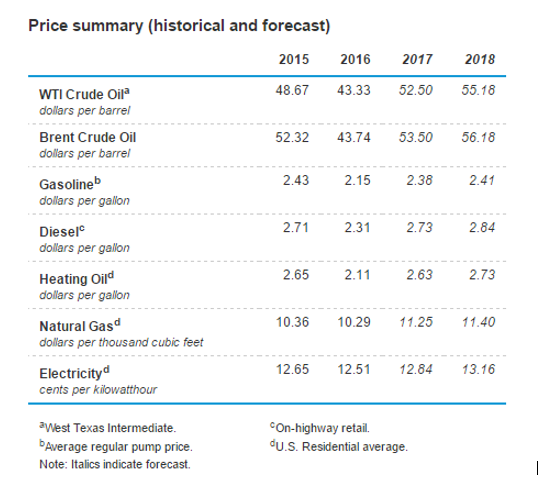

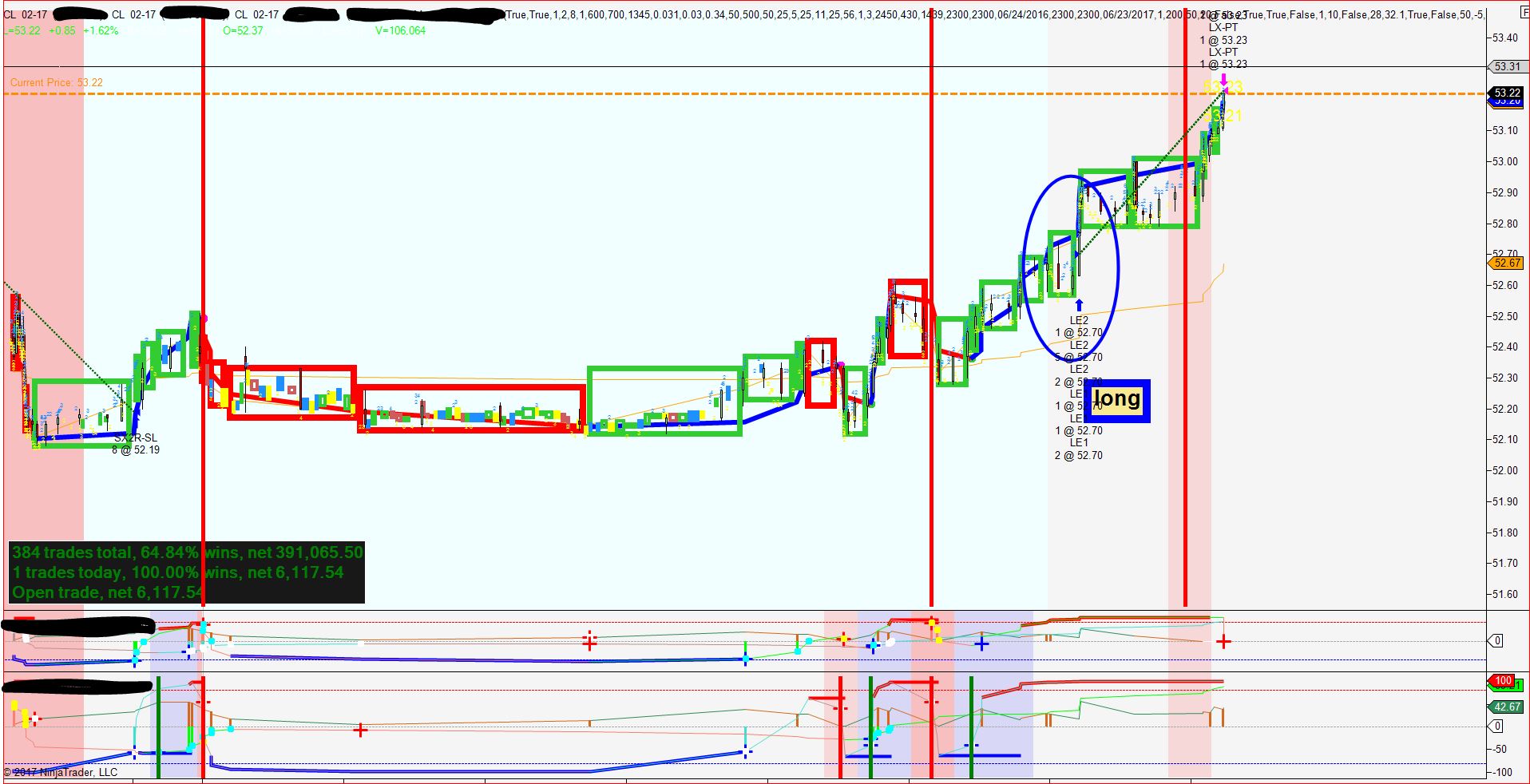

Traders said the higher prices in front-month crude futures were due to expectations of a tighter market. US West Texas Intermediate (WTI) crude oil futures were up 31 cents at $52.21 a barrel.

Here we covers major issues affecting the world oil market and provides an outlook for crude oil market developments for the coming year.

Crude Oil Market Opportunities in 2017

Heading into 2017, the oil price predictions by major organizations and investment banks are generally not widely diverging and hovering in the US$50-$60 range, but there have been some wilder viewpoints that are phenomenally bullish or direly bearish.

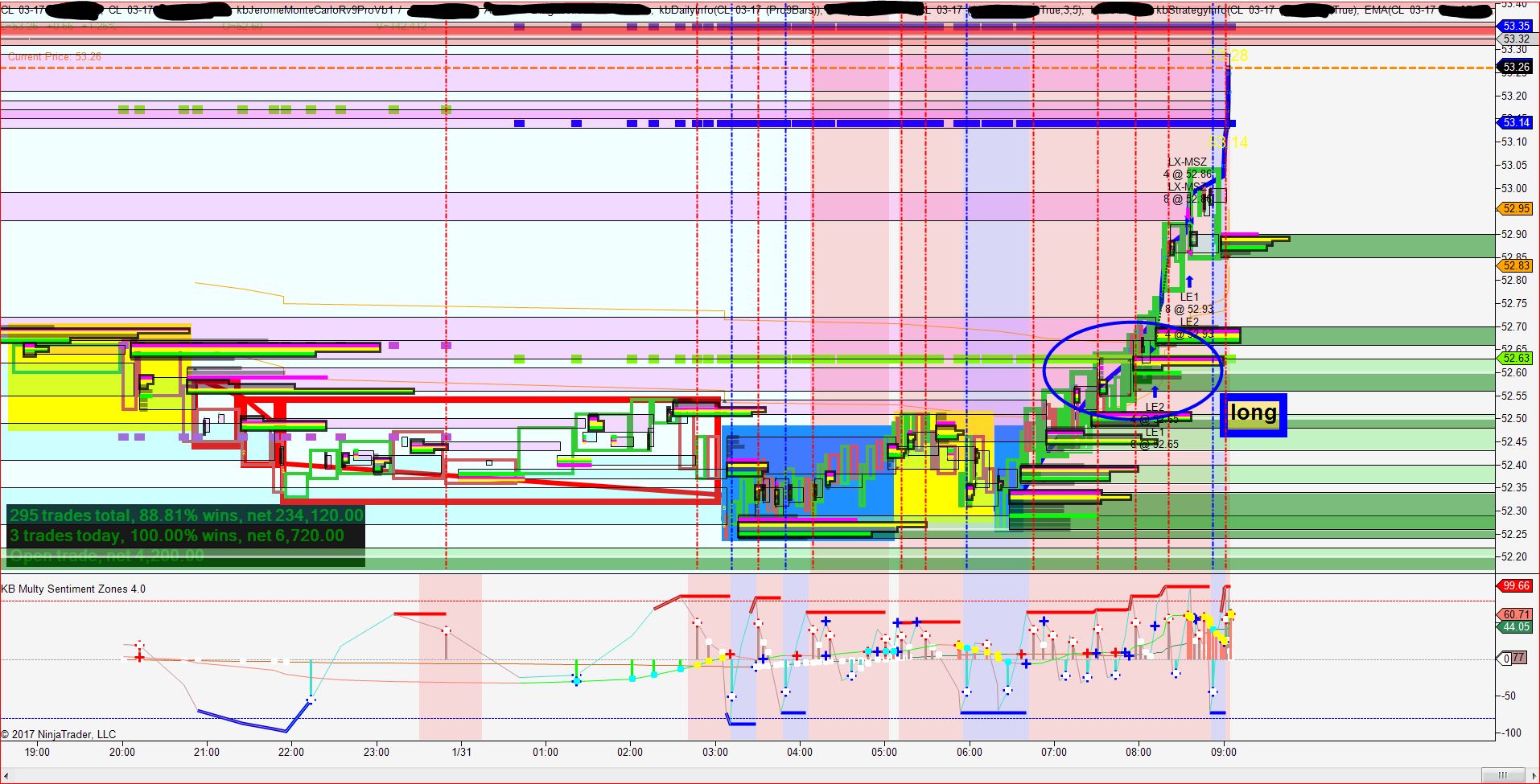

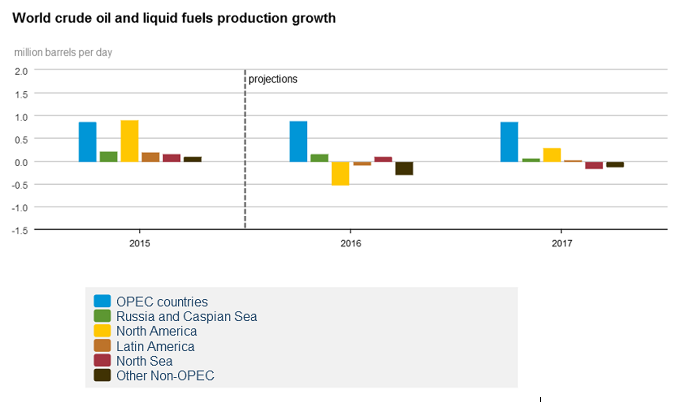

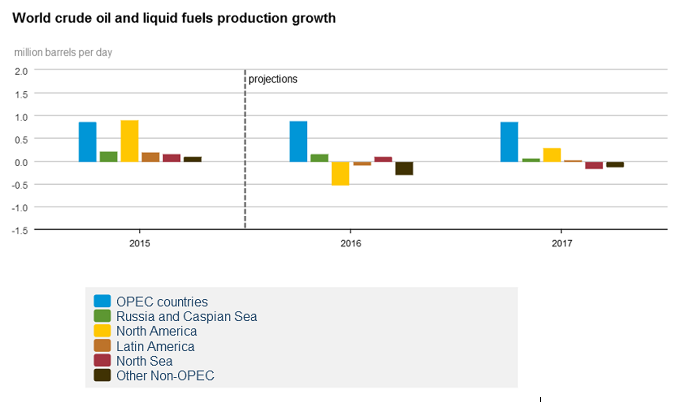

The US Energy Information Administration forecasts US crude oil production to average 8.7 million b/d in 2016 and 8.6 million b/d in 2017. Forecast production in 2017 is almost 100,000 b/d higher than in the previous forecast.

In Russia, recent oil production has been higher than previously forecast, with production exceeding previous records in recent months. In addition, the start-up of fields has resulted in a higher-than-expected outlook for Russian production. Russia’s oil production may increase 190,000 b/d in 2016 and 20,000 b/d in 2017.

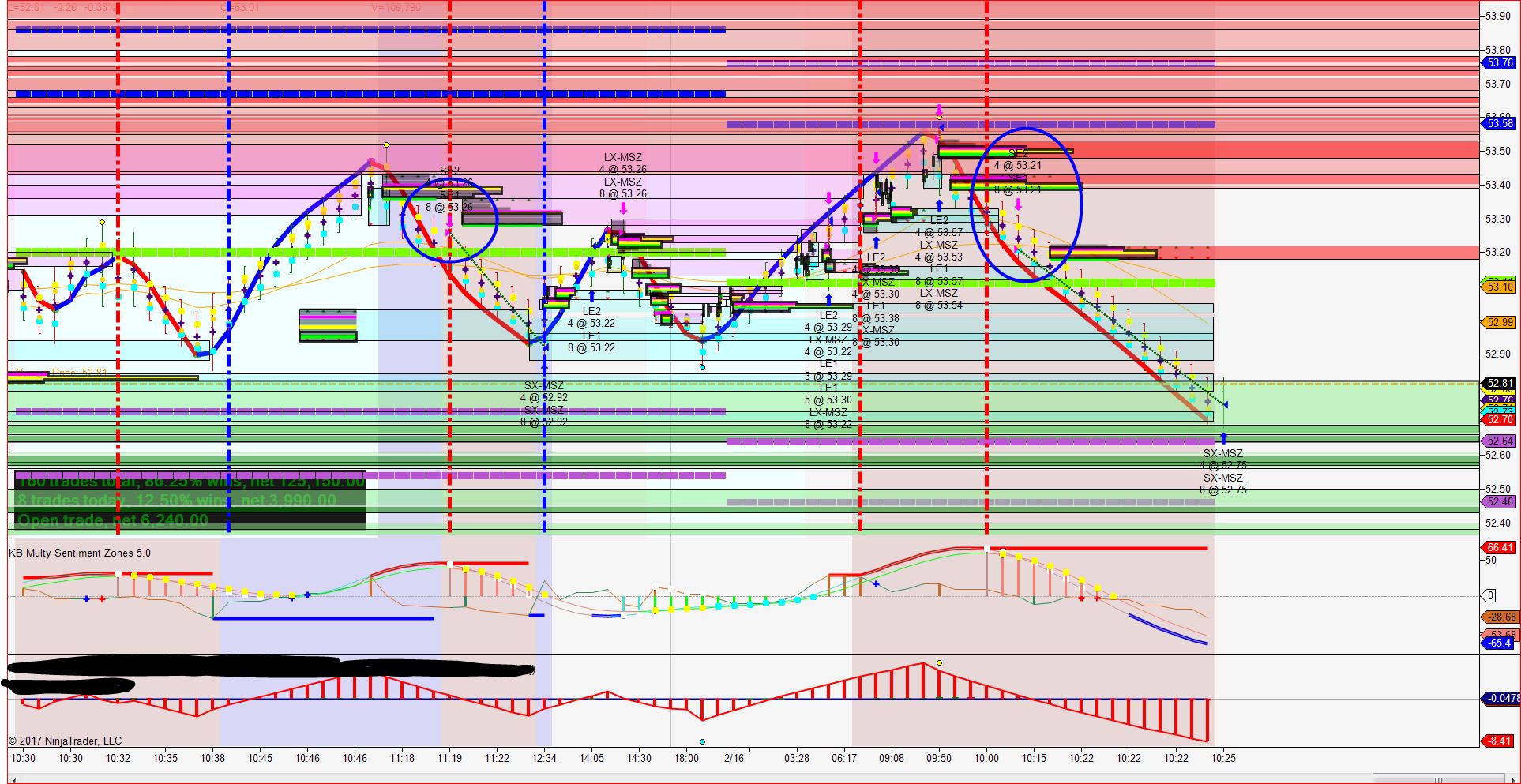

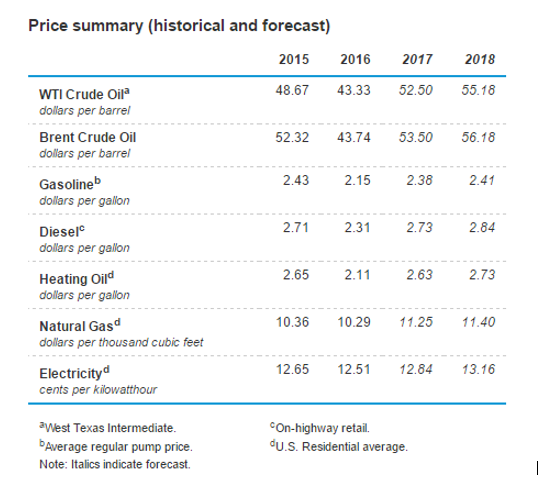

Brent crude oil prices are forecast to average $43/bbl in 2016 and $51/bbl in 2017, $1/bbl higher and $1/bbl lower, respectively. West Texas Intermediate crude prices are forecast to average about $1/bbl less than Brent in 2016 and in 2017.

“Pricing forecasts embed a sequential 500,000 barrel-per-day increase in U.S. crude production, raising domestic output to 9.2 million barrels a day by the end of 2017,” the bank said.