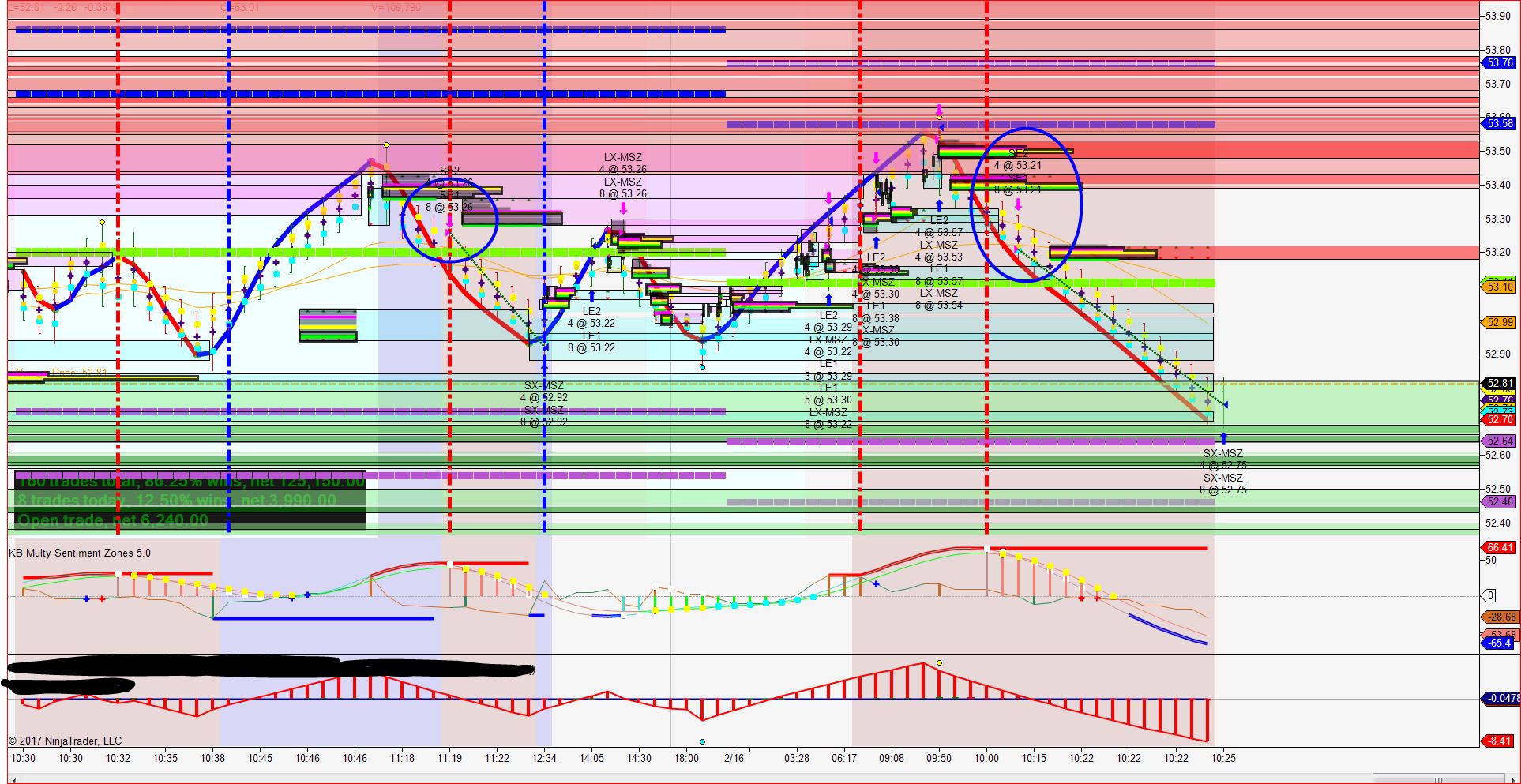

West Texas Intermediate Crude Oil Price

Oil futures remained higher Thursday after spiking to a session high following a smaller-than-expected rise in weekly U.S. crude inventories.

West Texas Intermediate crude oil for April delivery CLJ7, +2.16% on the New York Mercantile Exchange was up 97 cents, or 1.8%, at $54.56 a barrel after trading as high as $54.94 after the Energy Information Administration said U.S. crude supplies rose 600,000 barrels in the week ended Feb. 17.

Analysts surveyed by The Wall Street Journal had forecast, on average, a 3.4 million barrel rise. Data from the American Petroleum Institute, an industry trade group, late Wednesday had shown an 884,000-barrel.